Götterdämmerung

If your model didn’t predict inflation’s persistence, higher rates and robust growth, maybe it’s wrong

“For the foolishness of God is wiser than man's wisdom…

But God chose the foolish things of the world to shame the wise…”

– I Corinthians 1:25-27

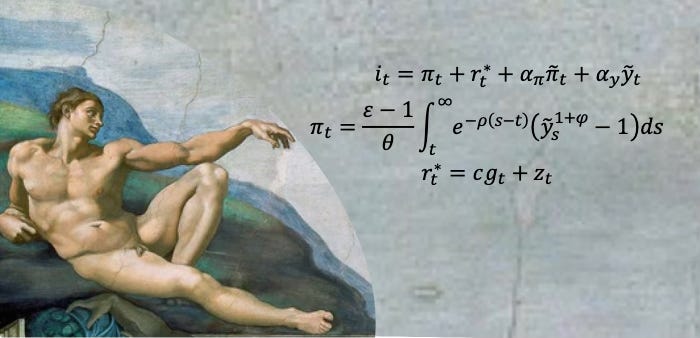

US rates’ volatility, especially at the 2y maturity, increasingly resembles a tennis volley. Last week’s volley – down on lower-than-expected headline inflation and revelation of the Fed staff’s recession forecast, up on a spike in inflation expectations and stronger-than-expected bank profits – well illustrates the cognitive dissonance that I described in Are we there yet? The consensus narrative of secular stagnation seizes on any sign of its fruition, only to confront an uncooperative reality of sustained robust growth and sticky inflation. Behind this cognitive dissonance is an overreliance upon, or misuse of models that omit key aspects of reality that currently are the main drivers of the economy: Localization and Being is believing.

Coincidentally, an extraordinary natural experiment in Nigeria well illustrates the power of Being is believing effects and the impropriety of common approaches to inflation forecasting that confuse relative with general price inflation. Similarly, the dynamic behavior of forecast errors of the Fed staff (and consensus) vividly demonstrates how overreliance on models misses major innovation cycles like Localization that drive the economy and markets. Yet, there are important signs of change within the FOMC that has implications for both the path and stability of rates.