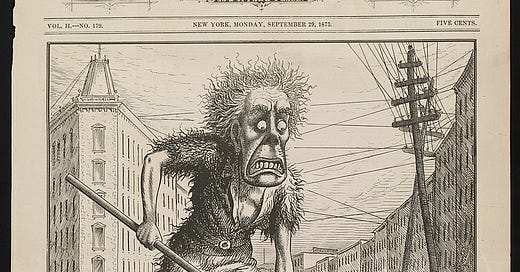

“Panic, as a health officer, sweeping the garbage out of Wall Street” - Library of Congress, LC-DIG-ds-04513

The last two weeks have seen three major bank resolutions, including one global systemically important bank (G-SIB) that turned European bank credit markets upside down, historic interest rate volatility, and a dramatic re-assessment of US rates expectations despite an upward adjustment of FOMC expectations for both rates and inflation.

Ironically, market rate expectations hit a new peak on 8 March, in line with the views I expressed in Are we there yet?, before the failure of Silicon Valley Bank (SIVB) plunged markets into uncertainty. A fundamental principal of Finance is that excess returns only come with risk and, as Frank Knight described a century ago, the most dangerous but profitable source of risk is Uncertainty. Piercing through markets’ ambiguity may offer great rewards, and a reasoned assessment of economic fundamentals and root causes of banks’ losses suggest that markets are meaningfully mispriced and may offer excellent risk/reward opportunities. In this note, I update my views and highlight the top opportunities.