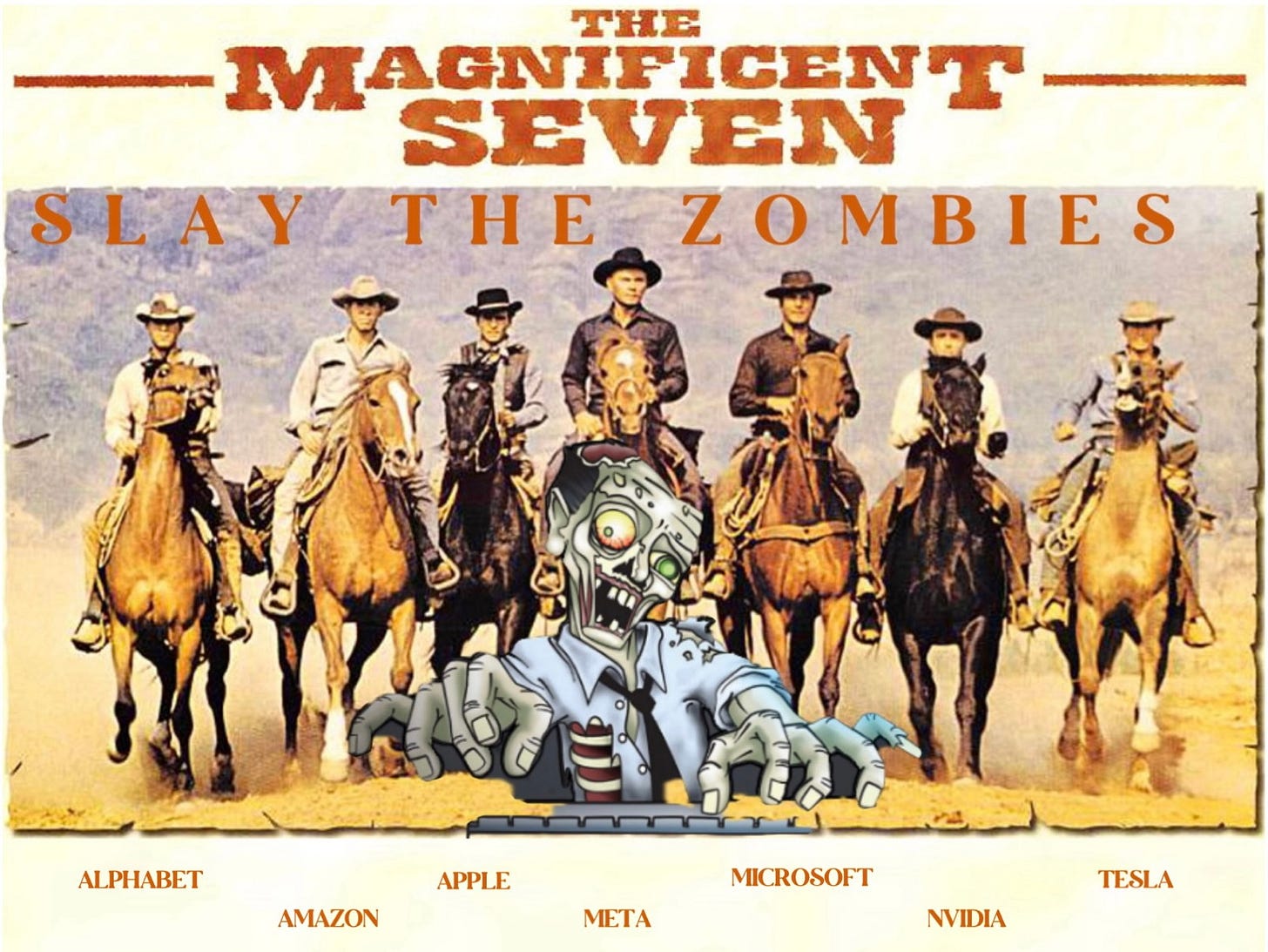

The Magnificent Seven slay the zombies

Real interest rates undermine labor hoarding incentives at tech monopolies

Last month a young former employee told me an interesting anecdote about one of his former classmates. His friend, a coder with little experience but a degree from a pedigreed university, had been hired by one of the “Magnificent Seven” tech companies at salary of more than $200,000. Despite actively seeking projects, he was never assigned any. After just over a year of being paid an exorbitant income to do nothing but wear a hoodie, sit on beanbags and drink free soft drinks, he was among those let go in recently announced layoffs.

One of the great mysteries of the current US economy is the 387,633 layoffs of skilled workers in tech – many from large platform monopolies whose share prices are flying – at a time when most other US firms are struggling to fill jobs at all levels.1

While many worry about an “AI bubble” in stock prices, the surprising answer to tech firms’ perplexing share price outperformance amid mass layoffs, oddly, may lie in the rise in real interest rates of the last 18 months. While real interest rates were negative, tech firms with monopoly platforms were incentivized to “hoard” labor, even when it was unproductive, to defend their monopolies’ long-run profitability. When real interest rates rose dramatically last year, tech firms with high P/E ratios (long-duration) were among the worst performing as the net present value of distant profits fell sharply. But the fall in value of long-term profits increased the relative value of short-run profitability. The firms responded by shedding their unproductive “zombie” workers to bolstering margins and markets appear to be rewarding them for it.

In this piece I present a simple model that illustrates tech monopolies’ profit-maximizing hiring decisions in different interest rate environments and demonstrate empirically how it explains these firms’ stock price dynamics in the last two years.